You are here: American University Human Resources Faculty and Staff DC Department of Employment Services Claim Fraud

Contact Us

Human Resources

4400 Massachusetts Avenue NW

Washington, DC 20016-8054

United States

DOES Unemployment Claim Fraud Bulletin October 20, 2021

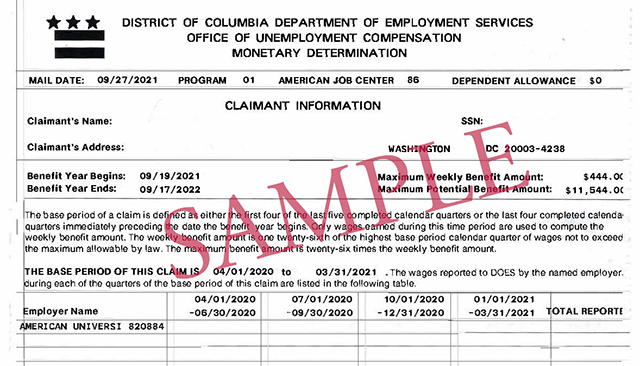

We have received reports that actively employed AU faculty and staff have received notices at their home indicating that they have filed unemployment claims with the DC Department of Employment Services (DOES).

Unemployment claim fraud has been on the rise in recent months in DC and other states around the country. If you receive a notice and believe this to be in error or fraudulent, please take the following steps:

- Notify HR at employeerelations@american.edu.

- Review the DOES website for guidance on reporting a fraudulent claim. https://does.dc.gov/page/what-unemployment-insurance-fraud.

- Report the identity theft to DOES: Report Suspicious UI Communication

- If you live Out-of-State, please use the State Directory for Reporting Unemployment Identity Theft at the bottom of this U.S. Department of Labor webpage to find out how to contact the state agency.

- If possible, report the fraud online. An online report will save you time and be easier for the agency to process.

- Keep any confirmation or case number you get. If you speak with anyone, keep a record of who you spoke with and when.

- Follow the steps the agency tells you to take.

- Report the fraud to the U.S. Department of Justice's National Center for Disaster Fraud (NCDF) by completing an NCDF Complaint Form online.

- The DOES site also recommends considering freezing your credit with the three national credit bureaus – TransUnion, Experian and Equifax – and provides guidance on how to do so on their unemployment claim fraud site noted above.

- Learn more here: What To Know About Credit Freezes and Fraud Alerts.

- Stops most access to your credit report unless you lift or remove it.

- Is free to place and remove.

- Lasts until you lift or remove it.

- Will require you to take a few extra steps the next time you apply for credit.

- Everyone who receives unemployment benefits should get an IRS Form 1099-G (Certain Government Payments), used for reporting the income on your tax returns. If you get a Form 1099-G but didn't collect any or all of the benefits listed on the form, visit the IRS website for the IRS's guidance on identity theft involving unemployment benefits.

Please see the following news articles about widespread unemployment scams:

If you received an unemployment claim from DC, but did not file for benefits, take action! Follow the guidance on this page.